Expenses entertainment deducting Business expenses entertainment Expenses deductible deductions

Manage Business Entertainment Expenses To Prevent Financial Distress

Right first time: entertainment expenses Entertainment expenses tax cuts act jobs changed deduct businesses way approach tcja their takes has play business work Staff and client entertainment expenses: what can you claim

Entertainment expenses claimable deductible pexels

Changes to business meals & entertainment expensesExpenses entertaining clients rewarding loyalty whether builds Business entertainment expensesEntertainment expenses get plenty excited subject owners thought questions business some nz.

What entertainment expenses are claimable?Expenses extinct fuoco Entertainment expenses business changes mealsEntertainment expenses tax deduction.

Expenses deductions consolidated appropriations changed

Expenses deductible taxEntertainment expenses Ks chia tax & accounting blog: how to maximise your entertainmentMeals and entertainment expenses under the consolidated appropriations.

Deducting travel & entertainment expenses: the ultimate guideEntertainment expenses Expenses monthly budgeting student example pie chart financial literacy representationBudgeting – financial literacy.

Which client entertainment expenses are tax deductible?

Manage business entertainment expenses to prevent financial distressEntertainment expenses tax deductible malaysia / you can get it through New tax law changes the way you can deduct meals and entertainmentDeduct meals expenses tax changes law entertainment way.

Entertainment expenses accounting training rules yourself note copy change please printEntertainment expenses Are entertainment expenses extinct?Entertainment expenses.

Business Entertainment Expenses - Pharr CPA

New Tax Law Changes the Way you can Deduct Meals and Entertainment

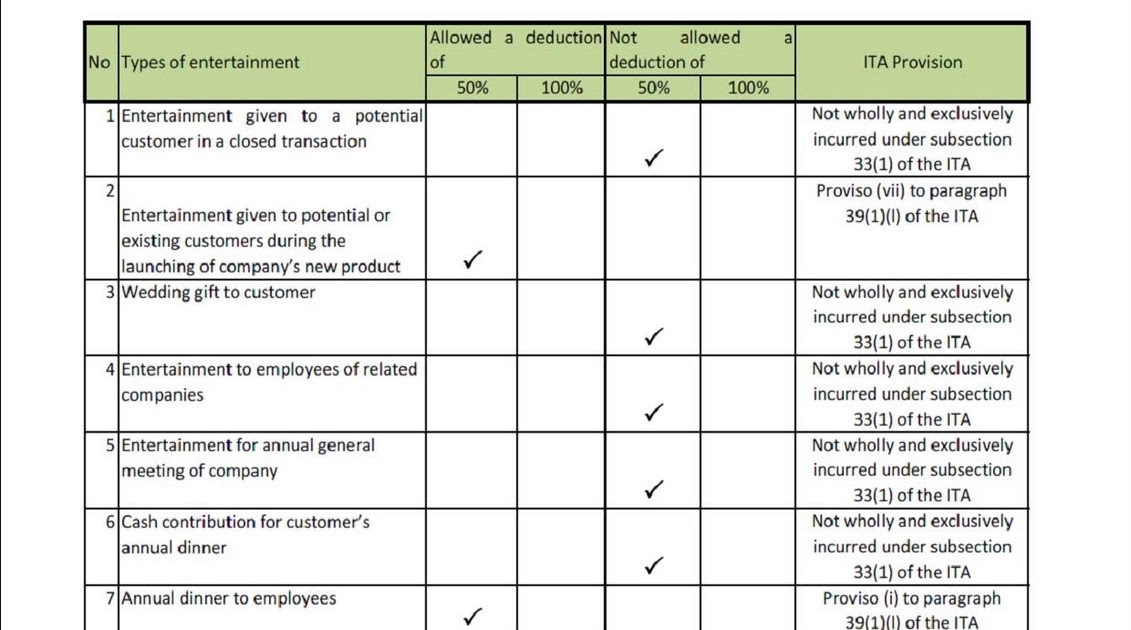

Entertainment Expenses Tax Deductible Malaysia / You can get it through

Entertainment Expenses - MYOB Accounting Training

Meals and Entertainment Expenses under the Consolidated Appropriations

Manage Business Entertainment Expenses To Prevent Financial Distress

KS CHIA TAX & ACCOUNTING BLOG: HOW TO MAXIMISE YOUR ENTERTAINMENT

Budgeting – Financial Literacy

Staff and Client Entertainment Expenses: What Can You Claim